- Library ›

- IT & Data Center ›

- SOX Compliance IT Checklist

SOX Compliance IT Checklist

Q1 - Internal Controls

Q2 - Internal Controls

Q3 - Internal Controls

Q4 - Internal Controls

Is this sample what you are looking for?

Sign up to use & customise this template, or create your own custom checklist:

Checklist by GoAudits.com – Please note that this checklist is intended as an example. We do not guarantee compliance with the laws applicable to your territory or industry. You should seek professional advice to determine how this checklist should be adapted to your workplace or jurisdiction.

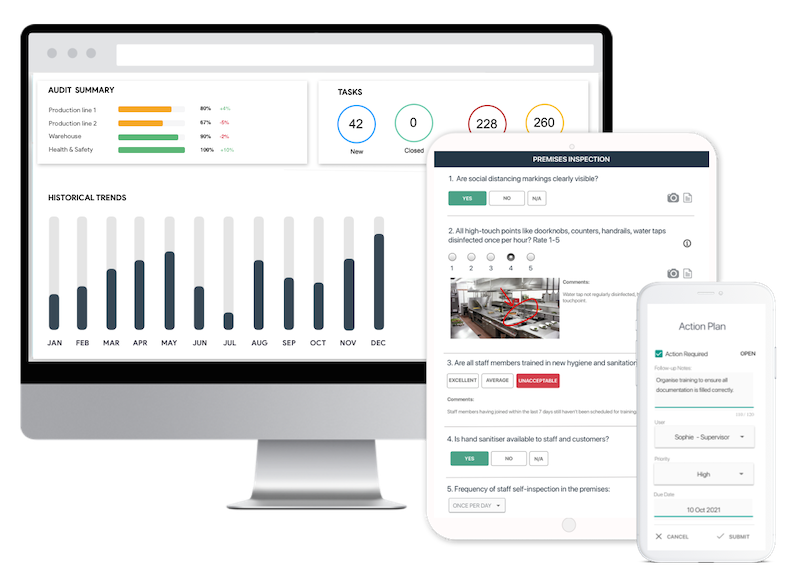

Easy inspection app for your digital checklists

- Conduct inspections anytime, anywhere - even offline

- Capture photos as proof of compliance or areas needing attention

- Instantly generate and share detailed reports after the inspections

- Assign & track follow-up tasks, view historical trends on a centralized dashboard